WHO 2018 Motion: 100% Inheritance tax

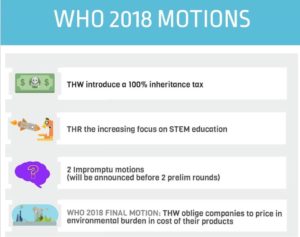

For the Winter Holidays Open (WHO) in Zagreb, two prelim motions and a final motion have been announced.

• THW introduce a 100% inheritance tax

• TH regrets the increasing focus on STEM education

• THW oblige companies to price in environmental burden in the cost of their products

This first post looks at the economics of the proposed 100% Inheritance tax.

Of 800 votes cast, these three received the most. Other motions considered were, from least to more votes: This House “regrets volunteer tourism,” “would ban short-term peer-to-peer lodging rental” (Airbnb), “would ban all used goods from the developed world to the developing world countries,” “as an individual, would not have biological children.”

Could A Tontine Be Superior To Today’s Lifetime Annuity

Many people don’t enjoy their work and look forward to an earlier retirement. Others may not mind working so much, but as they get older become less productive so earn less and less. Not wanting to run out of money, responsible people set money aside during their working years to draw upon in old age.

Those who die before they run out of money, give what’s left to family, friends, and charities. The WHO motion calling for a 100% inheritance would encourage people to plan more carefully, and perhaps live and die more carefully.

Of course people have long found it difficult to choose their time of dying, so often run out of money or died with too much on hand. The insurance industry offers possible solutions with “lifetime annuity products.” A triple redundant phrase since an annuity is: “a fixed sum of money paid to someone each year, typically for the rest of their life.”

So someone who has saved, say, $1 million for retirement but is unsure how long he or she will live could buy purchase at retirement, say age 65, an annuity. CNN Money in How much retirement income will $1 million generate?, (July 22, 2015) offers:

Let’s say that you’re a 65-year-old man and that you’d like to turn your $1 million nest egg into monthly payments that are guaranteed to last the rest of your life. Well, to achieve that goal you could buy an immediate annuity with your $1 million and, based on today’s payout rates, you would get roughly $5,660 a month for the rest of your life.

Annuities draw on mortality date to build actuarial tables projecting how long people are likely to live depending upon their current age, gender, and other relevant data (whether they smoke, drink to excess, go rock-climbing, and perhaps engage in competitive debate).

Today’s annuities can include payouts to beneficiaries as a form of insurance against dieing much sooner than expected or predicted. But they tend to reduce the monthly or yearly payments. If predicted mortality rates are accurate, those who pass away earlier than predicted pay for those who live longer than expected. Plus the annuity proceeds are invested and grow, so that higher payments can be made over time.

So, all this is to explain that a 100% inheritance tax would likely lead to a near 100% annuity rate, and perhaps be cheered by firms offering annuities. Of course a future frustrated House could make a motion to ban annuities too.

An alternative to annuities are pensions offered by companies, unions, and local governments, as well as “social security” systems (or schemes) provided by national governments.

An actuarially-sound pension is one where companies, unions, and local government put aside a portion of earnings and invest in safe securities (private sector and government stocks and bonds).

Pension problems come in different flavors. A relative retired in 1988 after thirty years working for Boeing has received his monthly pension of $1,700 every month since. Due to inflation the purchasing power of that $1,700 a month has been reduced to just $785 today. Or looking forward from the past, that original $1,700, had the buying power of the U.S. dollar not declined, would be $3,634 today.

Many pensions are now adjusted for inflation (the declining purchasing power of fiat currency), as is Social Security in the U.S. and other countries.

For more on the estate tax (or “death tax”) see The Very Bad Arguments for Killing the Estate Tax, The Atlantic, November 13, 2017 which includes an early history note:

Nearly 2,000 years ago, the Roman Emperor Augustus imposed the Vicesina Hereditatium, a tax on the wealthiest Roman estates upon the death of their patriarch.

For a United States historical perspective on taxes, see: Those Dirty Rotten Taxes: Tax Revolts that Built America by Charles Adams (The Freeman, February 1, 1999). Maybe better to tax death than whiskey:

The book abounds in historical detail. For instance, the whiskey rebellion of 1794: farmers were unfairly taxed for producing whiskey, which for some was the only viable means of transporting their corn. The farmers quickly rebelled and refused to pay the tax. The new federal government, which had only recently been founded on, among other things, the principle of fair taxation, responded harshly by sending an entire army, led by President George Washington in general’s garb, to force the farmers into compliance.

This 2017 National Taxpayers Union article, Tax Reform Should Finally End the Death Tax, calls for ending inheritance taxes:

Rather than saving and investing, actions that are essential for sustainable economic growth, older Americans with sizeable estates are encouraged to spend as much of their money as possible to avoid the tax. This is why eliminating the estate tax would result in GDP growth of 0.9 percent, and reduce federal revenue by only $24 billion over ten years, after factoring in economic growth…

Many journalists have called for a 100% inheritance tax. Why not fund the welfare state with a 100% inheritance tax? (The Guardian, July 24, 2017). Welfare state advocates note that”

In contemporary times, most people agree that tax should facilitate transfer of wealth from those who “have” to those who “need”. Public spending is messy and complicated, but the overall redistributive flow is from the relatively rich to the comparatively poorer.

But why should societies rely upon taxes to lift up the poor. Why not work to improve employment and education opportunities?

Wired’s in-depth The untold story of Stripe, the secretive $20bn startup driving Apple, Amazon and Facebook focuses on the key institutional or governance challenge that limits opportunities for entrepreneurs around the world. Local regulations, taxes, and corruptions are difficulties faced by start-up enterprises around the world. But lack of financing makes other challenges even harder:

According to the World Bank’s Small and Medium Enterprise Department, there are between 365 and 445 million micro, small and medium-sized enterprises in emerging markets, contributing up to 60 per cent of employment and up to 40 per cent of national GDP. The main problem these companies face is access to finance. So how can entrepreneurs from emerging nations join the global market and help lift the wealth of their nations? One of the solutions comes from a small village in Ireland called Dromineer, of population 102 and the birthplace of the world’s youngest self-made billionaires, Patrick and John Collision.

The Wired article then describes Stripe, the low-cost payment processing company that is streamlining sales and investments in developing countries firms:

For Mustafa Amin, Atlas offered a solution to his perennial problem – no-one wanted to invest in Middle Eastern companies, “because the instability meant they doubted our legal system – to protect their money, they need to have a strong legal system.” Since BreadFast became a US company, Amin has already landed funding from Silicon Valley venture fund 500 Startups.

Today, 20 per cent of tech-based Delaware C-Corps started on Stripe Atlas. Alvarado oversees the partnership between Atlas and Silicon Valley Bank. For him, building Atlas is a visceral part of his own personal story – his father grew up in poverty in Honduras and he was born into difficult circumstances.

An 100% inheritance tax will do little to assist wealth-creation opportunities and enterprises around the world. However any substantial inheritance tax is a danger to family-owned companies. A company built over years and worth millions is at risk with the founder and owner dies. Suddenly inheritance taxes have to be paid out of revenue, savings, or borrowing. Or, I guess with a 100% inheritance tax, the whole enterprise is handed over to the state. For more, see How Do Estate And Inheritance Taxes Affect Entrepreneurs? (Forbes, May 7, 2018)

A hated tax but a fair one: The case for taxing inherited assets is strong (The Economist, November 23, 2017), make the case for this tax (but likely not at 100%). (I’ve reached my monthly article limit and can’t read it)

And again from The Guardian: Use inheritance tax to tackle inequality of wealth, says OECD: Wealth inequality is even greater than income inequality and is on the rise, says new report (April 12, 2018)