Stoa Policy Choices: SS/Medicaid/Medicare Reform

Anthony Severin’s post for Ethos Debate discusses the Stoa policy choices for 2022-23:

• Resolved: The United States Federal Government should substantially reform one or more of the following programs: Social Security, Medicaid, Medicare.

• Resolved: Housing and urban development policy should be substantially reformed in the United States.

• Resolved: The United States Federal Government should substantially reform its policy towards one or more countries in Europe.

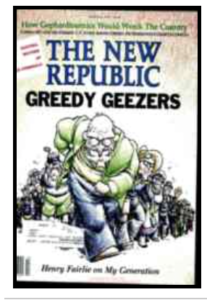

Severin begins by noting the first was the 1988-89 National Forensic League topic. I was education director at the Reason Foundation that year and we published an “Econ” study guide on the topic (titled: Greedy Geezers! and drawing from a controversial 1988 The New Republic article). We mailed the study guide to some 3,000 high schools with debate programs.

(I was young then and enjoyed the idea of stirring things up to draw attention. Probably not a good idea.)

Social Security then and now collects payroll taxes from those working and redistributes that money to retired people. The program can seem healthy for decades when when taxes are collected from lots of young workers for far fewer who have retired.

Many think of Social Security as a kind of pension where people pay into their own retirement account and later draw that money out. Instead Social Security is a transfer program. Money collected each month from workers is paid out that month to those receiving Social Security. What happened to the early surpluses, when taxes collected was far higher than payments?

For many decades far more money was collected each month than paid out, but the Federal Government spent that money and placed IOUs in a “lock box.” Further, early Social Security tax rates were just 1% of wages, and have risen over the decades to 12.4% (with employers paying 1/2. Funds that would otherwise allow higher wages so considered by economists to be actually paid by workers).

The lock-box story linked above goes to a 2007 Brookings Institution article with some history:

Following his successful 2004 reelection campaign, President George W. Bush designated fundamental Social Security reform as his top domestic priority. This was anything but an impulsive decision. As early as his 1978 congressional race, he had suggested that the Social Security System could not be sustained unless individuals were allowed to invest the payroll tax themselves. Overriding the doubts of some political advisors, he raised the issue while announcing his first presidential race, declaring that “We should trust Americans by giving them the option of investing part of their Social Security contributions in private accounts.”

Students can choose from hundreds of articles and books proposing reforms for Social Security, Medicaid, and Medicare. All three programs are underfunded and unsustainable in their current form. Here are a few realities and reform options.

- Gradually raise the retirement age from the current 67 to 70. People can retire earlier with reduced monthly payments. Americans live longer now, and this would follow an earlier increase in retirement age. When Social Security was passed in 1935 most people didn’t retire, they more often died before collecting any SS benefits. Men on average died at age 60 and women at 63. But some lived much longer and outlived their savings (which in 1935 were depleted by the Great Depression). Unemployment rates were 20% in 1935, down from 25% in 1933. Social Security was a New Deal program to aid elderly unemployed and to encourage the over 65 still workers to retire, to increase job opportunities for the unemployed.

- That was then, this is now and though workers can receive receive full Social Security at age 65, they live on average to 80. So we have far more retired and receiving Social Security payments, and living much longer. Demographics are central to the current problem. The Baby Boom generation is retiring and later generations are smaller. So fewer younger workers to try to pay for the larger retired population.

- Savings and sound money offer an healthier alternative to welfare state transfer programs. My uncle retired from Boeing with a pension he had paid into over thirty years. But that fixed pension payment decreased significantly over the decades of his retirement as inflation reduced the purchasing power of the US dollar.

- Retirement Savings Accounts have been recommended for decades. Just as Chile and other countries transitioned from a centralized top-down to private retirement accounts, the U.S. could too. Allow anyone who wants to stay in the current SS system to stay, but allow people to exit SS and save on their own elder years in private savings accounts and pension plans. (A danger here is that government can later confiscate these private retirement accounts, as has happened in some countries.)

On to Medicare and Medicaid. I will post more on this later, but these programs are also unsustainable. Administration costs are huge in the current systems and incentives are all mixed up for allocating scarce medical care resources. Allow the elderly to opt-out of the top-down Medicare system with Health Savings Accounts. Also, interestingly, Health Savings Accounts can provide a better vehicle for saving for retirement.

The CDC reports: 90% of the nation’s $3.8 trillion in annual health care expenditures are for chronic (obesity, diabetes, heart disease) and mental health conditions. [and] The Nutrition Coalition says forty years of federal low-fat food guidelines is root cause for obesity, diabetes, and heart disease epidemic.

For more, see Overweight? Blame Energy Balance Theory and Dietary Guidelines (Normal Nutrition, March 28, 2022), and my Brief Analysis #142 for the Goodman Institute (link to pdf).

Here is my presentation for the Association for Private Enterprise Education from last week:

Next post will discuss the history and economics of: • Resolved: Housing and urban development policy should be substantially reformed in the United States.