Misleading Numbers with China’s Economy

[I wrote the text below on July 6 but somehow didn’t finish. Now the China’s stock market falling, the notes below and links may provide helpful background. Also valuable background for current financial and economic turmoil in China is Tyler Cowen’s 2012 NYT article: “Two Prisms for Looking at China’s Problems.”]

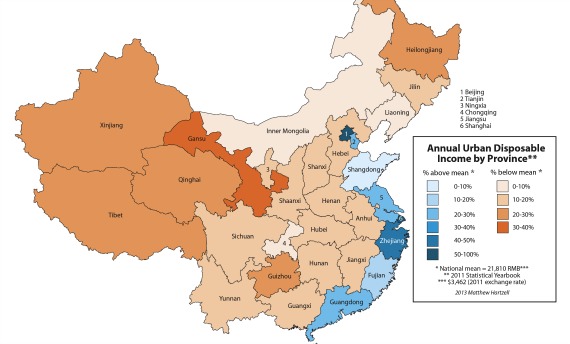

China’s rapid economic development is very good news for both consumers and producers in the United States. Incomes are rising across Chinese provinces open to international investment and trade. Factories across these provinces pay higher wages to higher skilled employees in more advanced factories.

A Business Insider article reports new Blackrock research suggesting a major economic crash will soon hit the Chinese economy (“BLACKROCK WARNS: China’s debt has lost its potency and is now ‘turning into poison’“)

Across China’s fast-expanding middle income sector, millions are opening brokerage accounts each week, hoping to make their fortune in China’s fast-rising stock markets. A Bloomberg News article reports “There Are Now More Stock Traders in China Than Communist Party Members.”

When more Chinese decide to put some or all or more of their wealth into the stock market, this new demand pushes stock prices up. Everyone already in is thrilled, and new investors hope the ride will continue. Forty million new brokerage accounts are part of the reason China’s stock markets were up 40 and 100 percent in the last year:

China added more than 7 million individual equity traders in June through the 26th, according to the Chinese clearinghouse, which started compiling the number of investors in May, replacing the original data set on stock accounts after regulators allowed investors to open multiple accounts. More than 40 million accounts were added in the 12 months through May.

Another reason for the increase is the newly wealthier stock market players, seeing their stock portfolios surge in value, were invited to borrow money from their brokerage firm to buy more stock. So in theory they could make more money faster by leveraging their money.

That worked okay until last week. But with stock prices now falling (20% so far), borrowing leverages their losses.

Real GDP fell from10.4% in 2010 to 7.8% in 2012, to 7.4% in 2014.