Fiat Money Inflation in France

From the fall of the Roman Empire to the rise of National Socialism in Germany past inflations have wrecked civilizations (see Commanding Heights segment on German hyperinflation). Current inflation disasters include Venezuela and Zimbabwe. Hyperinflation, Encyclopedia of Economics and Liberty offers an overview.

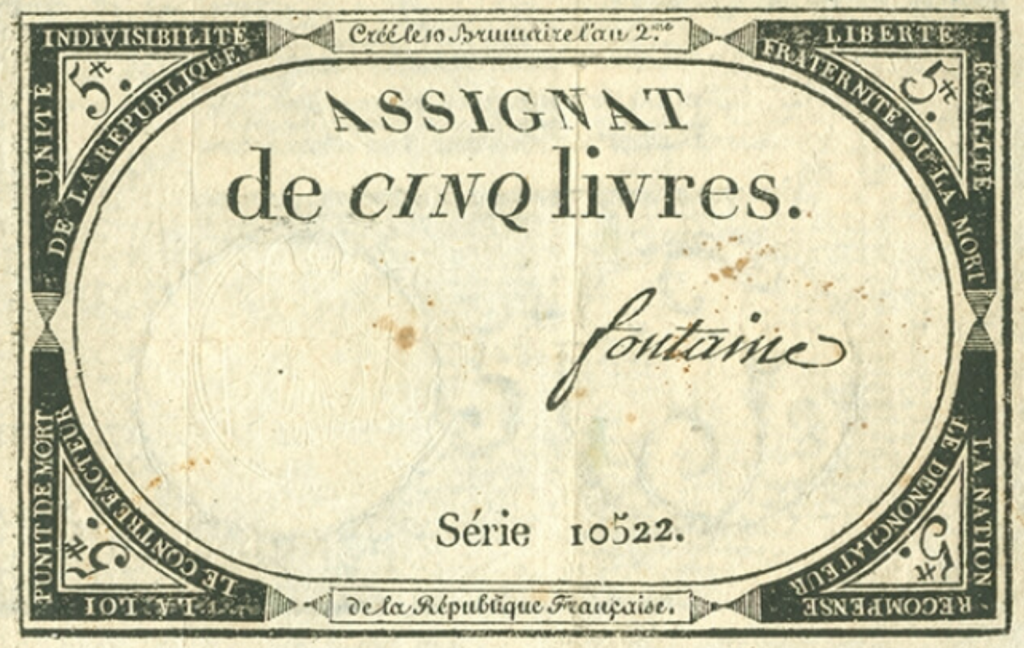

A paper (fiat) money, the Assignat, played a key role in another historical disaster, the Reign of Terror, following the French Revolution. This story is told in Andrew D. White short book, Fiat Money Inflation in France [1876], available on the Liberty Fund’s Online Library of Liberty.

Students researching the banking, finance, and monetary policy debate topic can learn from history the many ways mismanaged monetary policy and financial regulations have damaged economies, erased middle class savings, and fueled revolts and revolutions.

The Great Inflation of the 1970s distorted the U.S. economy and destroyed the retirement of millions of older Americans. This Investopedia post tells the story:

The great inflation was blamed on oil prices, currency speculators, greedy businessmen, and avaricious union leaders. However, it is clear that monetary policies, which financed massive budget deficits and were supported by political leaders, were the cause. This mess was proof of what Milton Friedman said in his book “Money Mischief: Episodes in Monetary History“, inflation is always “a monetary phenomenon.” The great inflation and the recession that followed wrecked many businesses and hurt countless individuals.

This history of past inflations small, great, and hyper, is relevant to today’s deficits and national debts in the U.S., Japan, and across Europe. How are monetary authorities facilitating these growing deficits, and what will be the consequences?

The Federal Deficit and Debt: Trouble Ahead? (AIER, March 30, 2017) looks from early 2017 at the federal debt and projected deficit. Two years later, Debts and Deficits are Out of Control (AIER, February 5, 2019), outlines the deeper debt and deficit hole dug for Americans, following mostly from expanding entitlement programs:

In fiscal year 2019, the CBO projects, Social Security spending will be $1.04 trillion and Medicare plus Medicaid spending will come to $1.17 trillion. All “mandatory” expenditures in the budget will total $2.7 trillion out of entire federal government spending of $4.41 trillion.

Thus, entitlement spending will make up more than 61 percent of all of Uncle Sam’s spending in fiscal year 2019. If we add on the legally required payment of net interest on the federal debt of an expected $383 billion, then all of these obligatory expenditures under current legislation come to $3.08 trillion, or close to 70 percent of the government’s budget. Another 15 percent of the 2019 budget represents spending on defense. The remaining 15 percent is on non-defense discretionary spending.

The U.S. Treasury and Federal Reserve have the task of securing the funding for U.S. government spending. This CPA Journal article outlines the challenges, The Unsustainability of the Current U.S. Fiscal Path (December, 2019).

Through American history, accepted government policy was to run surpluses most years in order to pay down the federal debt. When recessions hit or during wartime deficits and debt increased. This is good policy for individuals and families as well. Always set money aside during normal times so savings are available during downturns and emergencies. But saving is not a fun as spending, so requires discipline.

Fiscal discipline is even harder when spending someone else’s money, as politicians have the power to do. Current Federal Reserve policy enables the federal government to continue trillion dollar deficit spending by monetizing the debt. And as they say about things that can’t go on forever…

So federal monetary policy and deficits are intertwined. Is it possible to fix or at least improve monetary policy without reducing federal spending? The Federal Reserve and Government Debt (AIER, March 6, 2017) takes a look. Turns out the federal debt is now a profit center for the federal government. That can’t be a good thing:

The government spends beyond its means and issues debt to cover the difference. In stage two, the central bank issues bank reserves and uses the proceeds to buy up government debt. Over time, the central bank usually earns a profit, because the longer-term debt it typically buys usually pays a higher rate than the bank reserves it issues. In stage three, the central bank remits any profit to the government. …

Federal Reserve remittances to the Treasury have risen with Federal Reserve holdings of government debt. Remittances have risen from $34.6 billion in 2007 to $92 billion in 2016.

The Federal Reserve and Government Debt